I have never had a Roth IRA that had deposit fees at all. In fact, I didn’t know such a thing existed until today.

+1

Perfect. So it’s just mine. ![]()

I know I have a coworker who has the same type of account, I guess he just decided to live with the fees, because I’m sure he asked more questions than me. I will talk to him next time I see him.

So honestly, you might want to move it to another brokerage because fees are going to keep eating away at what you’ve got regardless of additions you do or don’t make, at least from what I can tell (ex. google thinks there’s an annual ‘custodial fee’ on American Funds regardless of your actions).

Roth IRAs as a type of account have no fees on deposit and most investments don’t have front load fees either, that’s entirely a ‘feature’ of the brokerage/company you’re at and the investments they offer, and there are better options.

If you were interested in moving funds to another brokerage, you’d want to look at a trustee-to-trustee transfer…I haven’t done it, but generally the brokerage you’re going to is happy to help you bring money to them (although this is one case where I’d be wary of Vanguard–for a long time they had a reputation for excellent customer service, but there have been a couple articles at the other place about it going downhill recently)

I’m sorry your account is so crappy! Capitalism, ugh.

My advisor said there is no yearly maintenance fee, but every deposit has one. So, I feel like now that it’s done I might as well leave it there?

It’s American Funds through Capital Bank and Trust. Our work Simple IRA is through there but has no fees because our group total has a high enough balance that there are none. In the beginning we did have some fees but that was many years ago.

I knew there would be an initial fee to open the account, I did not know it was on every deposit. My fault for not asking enough questions!

what is the MER on the funds the money was invested in? do they have any trailing fees that he is being paid through?

what is the fee to take it out? are there additional fees to take out the money from specific funds if they haven’t been in there for a certain amount of time?

How is the advisor being compensated if there isn’t an annual fee? What is the AUM % in addition to the MERs?

He told me there is no fee to take the money out.

All the rest of that is over my head. ![]()

Yes - I agree with moving your account. And consider not using your financial advisor more than you have to for work because I am fairly sure that guy is screwing you over with his own fees (or the fund kicks back money to him).

I suggest you read some articles on JL Collins blog - pretty sure he had at least one post showing how fees majorly erode your return on investment. It’s actually pretty shocking - at least a 33% decline versus very low fees, but in my memory it’s actually more like 67%.

Ok. So what’s done is done and I got my punishment for not asking enough questions. I will not put any more money into this account in the future, it can just grow as is.

Thanks for the help! And the bad news. ![]()

But it won’t grow as much as it would with a lower fee vendor.

Also, you can open another Roth with a different vendor. It’s really easy, you can just create your user account online, and transfer money when you are ready - put in your bank account info, vendor will do 1-2 test deposits to verify account, you log back in within a couple days of the test deposit to verify the amount and your account is verified and ready for actual transfers.

But there are no additional fees after initial deposit so won’t it now just increase or decrease along with whatever the market does?

we are questioning if the ongoing management fees or fees to hold the funds you have used to track the market are higher than average and thus would be a drag on your performance.

your advisor is getting paid somehow. it might not be a straightforward line item being shown you. It might be AUM, it might be MER, it might be a combo. They obviously don’t want to make it easy for you to find out.

please note, it is Not Your Fault that this is difficult and confusing.

they make their money by making it difficult and confusing for people, and they are very good at it

I fell down this morning while jogging and skinned my knee and banged it up. The joint hurts. I am taking ibuprofen and icing it. How do I know if I should take my lunch walk or skip it in favor of rest? Or taking the elevator vs stairs?

I just got new insurance so I don’t have a doctor to ask.

I’d say since it hurts, skip the walk today.

Test it out, a short easy stroll may help with blood flow and healing, but don’t push it. Just see how it feels during the day and how it responds to the moving around you have to do at work. Any intense or sharp pain is an obvious warning. Dull aches or stiffness are more ambiguous.

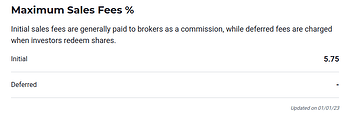

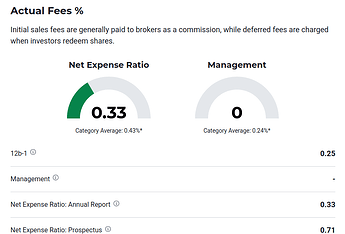

So this is what I’d double check. The account itself may not have additional fees, and I’m guessing that’s exactly your advisor told you, but the funds you’ve mentioned almost certainly have internal fees that aren’t getting a mention. They’d be called something like expense ratios (which is maybe why the advisor ignored them if you just asked about fees), and your advisor should be able to give you a list of them. Or if you’ve got the symbols for what you’re invested in, basically the letters or the specific names of the funds, you can look them up yourself. Ex. just looking up “American Funds Target Date 2045 Retirement Fund, AAHTX”, I can find a costs and fees page (https://money.usnews.com/funds/mutual-funds/target-date-2045/american-funds-2045-trgt-date-retire-fd/aahtx/fees) with the relevant parts

So the first part is what you pay to make the initial investment, but the second part are the fees (expense ratios) that get paid out every year you’ve got money in the account just to hold that investment.

This is where when you can have a fund with fees of 0.07% that performs exactly the same as the fund above with a 0.7% fee, but you’re paying 10 times as much just to invest in the second fund.

ETA–this is also where the ‘money lost to fees’ charts come from…it’s usually not the initial investment fees that get you, it’s the year-on-year ones that they hide under other names.

I’d skip an extra walk but not try to rest at home or work unless it feels worse by doing so (like if it’s tender 2/10 at rest and 3/10 walking but stays in the 2-3 zone that’s fine. If stairs are a 5, skip at the library because you have them at home). Total immobikity is always a bad call but your life doesn’t have that option anyway

That’s really helpful framing, thank you! I think I tend to get in my head with relatively small amounts of pain because I worry it will Hurt Forever. 2-3 is pretty accurate.

A slow lap around the building might be a good compromise- I need the sun exposure to perk me up for the afternoon but I don’t want to overdo and slow down healing.