Week 1.5 update(?): Savings increased to $564.34. over 50% of my goal for the month for savings. Going to look through things to sell online. Also started making sourdough bread so wish me luck!

First Check-in!

My goal was to interact with my budget everyday and I did! I also realized what was the best time to do it, right now just prior to going to bed is really the best time.

Last year I experimented by creating one big category for my true expenses and putting a lot or cash in that category but it didn’t work for me, so I used some YNAB templates to add back the different categories. And since the beginning of October I had to add a bit more.

My bookmark reminder tells me today is the day to check in!

October grocery budget remaining is 750.52/900. This seems good so far? OK, I looked up percentage calculators and we’re 33% through the month with 83.39% of the budget remaining, so that’s definitely good!

I realized part of the reason August’s food budget was so high is front-loading school lunch money. And apparently we qualify for free lunch now, so that part of the expense will not recur.

I think I’ve been doing better entering transactions. At least, last time I reconciled it wasn’t much of a struggle.

This is a great time to be budgeting more carefully since I’m out of work due to the government shutdown!

I did manage to get in touch with the house cleaner and find out how much she was supposedly paid for her services. She says she got the payment, but I can’t find it anywhere in our transactions, which is very confusing. Also, the difficulty getting answers makes me think I should start the process of looking for a house cleaner again (I really want to be able to communicate easily with anyone doing work in my house), which is demoralizing.

ETA: Forgot to mention my “clear the pantry” goal—I used some cacao nibs and, more importantly, an entire bag of chocolate chips. Probably more stuff has been used from the pantry, but that’s what I used.

I laugh at my former self. Eleven-days-ago me had NO IDEA. I was a child, and now I am many decades older, and many dollars poorer, but hopefully richer in experience.

Goal 1: Cheap and prepaid thrills. We are doing OK at this but (like @BiblioFeroz ) I forgot about Halloween. I spent about $20 on materials for my kid’s Halloween costume. So I have $5 left for kid enrichment this month.

Goal 2: Plan ahead. I have grocery shopped twice and gone to Costco once. All three times, it felt absolutely necessary. I waited until we were out of many essentials, not just nice-to-haves, and, well, this is where we are. We shall see how long I can stretch it until the next trip. So far I have spent $375.67 on groceries. This is all thanks to silly activities like COOKING at HOME and MEAL PLANNING. Madness.

Goal 3: Pay a bill! Perhaps the best news is that I learned from my insurance that I don’t owe as much as the urgent care thinks I did. I could be on the hook for $2-300 less. Now I just have to wait for the appeal to be processed.

Overall goal: Spend under $4000 this month. Well, all the big expenses are paid–utilities, mortgage, Costco… and we have spent $3100, leaving $900 for the rest of the month.

I don’t think I’ve ever been as financially conscious about every dollar as I have been this month. Many people live like this all the time, but for better or worse, this is new for me.

So far what I am learning is: my spending is intentional and reasonable. My goals were not.

(I know I can recast; I’d just like to see how far I get.)

Week 2 checkin: my baselines are all estimates. They may be a little high but that’s ok, as I’m doing this to try to figure out where categories should be.

Doing ok so far.

Groceries- 149/600

Fuel- 53/200

House maintenance- 87/300

Dining out- 15/100

Cat food- 13/100

To be fair, we have cat food and regular stuff in the freezer we are eating.

According to the budget tracker, I am at $2552/$4184 for the month. ($1579 was property taxes, but every month always has something special coming up. For example, November Black Friday sales will include annual contact purchase!).

Regardless, still good to see how close we can come to my target!

![]() First official check-in! I stuck to paying cash-only for takeout. I’m also tracking what food I spend that cash on in the notes app of my phone.

First official check-in! I stuck to paying cash-only for takeout. I’m also tracking what food I spend that cash on in the notes app of my phone.

Oct 1-11 I spent $145.05 out of my $300 budget. We’re 35% of the way through the month and I’ve spent 48% of my budget. ![]() Maybe I’ll get some breakfast pastries and cold brew from the grocery store, so the grocery budget can absorb some of this takeout spending.

Maybe I’ll get some breakfast pastries and cold brew from the grocery store, so the grocery budget can absorb some of this takeout spending.

I thought we were going to be waiting for a train to the airport so i bought an expensive iced coffee so we could snag seats, only for the train to pull up 30 seconds later. So that was a fail.

I got one mystery bag (4.99) so the shadowy one could have an extra breakfast sandwich since we were down to just rice pucks. Will can it a win, even though I didn’t get my fave pastry

We purchased a quiche and a tart for travel day since air canada will not feed us. Also a big bag of chips, because the shadowy one is unable to think about what they want for travel more than a day ahead.

I was able to stick around while the electrician was in, so that saved us from a coffee shop seat rental purchase.

We saved a dinner out by pulling potstickers out of the freezer.

Overall pretty close to goals

Week 2 check in

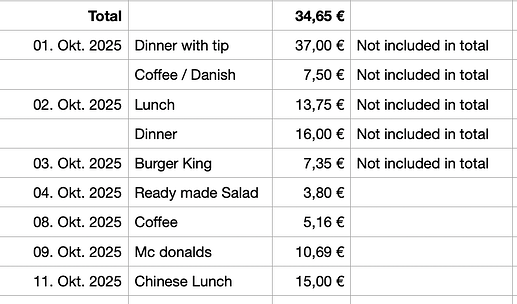

Pretty good so far, I was out today in Hamburg with a friend but we only had a small lunch at a Chinese place, no fancy coffee ore sweets. ![]()

First check-in!

- No eating out - success! We ate out so much while my parents were in town that I have absolutely no desire for restaurant food for a while, lol

- Eat up freezer and pantry - making progress! Multiple items have been consumed out of each.

- $600 grocery spend - still under it, but not by much.

- No gardening spend aside from 3 projects - success!

Week 1 check in:

I organized my envelope system.

I prepared a kit for a customer and took some fabric samples to another. The kit will bring in $70 and the one fabric sample the lady bought was 50 cents.

I was on a Zoom chat with other professional artists in my media, and was told I am selling kits entirely too cheap. I will talk to my mentor who runs the group I sell at. She has her pulse on what’s affordable for that group and what’s reasonable for me.

I redistributed the cash in my cash envelopes. I have a GIC coming due the end of November, and I’d like to top it up to $5000 before renewing. It’s at $3200 right now. I technically could do it, but it would mean severely limiting Christmas spending.

I ordered a couple of hardcover books I designed from an online outfit. They arrived with minimal packaging and very noticeable damage on all corners. I complained. They are replacing them free of charge. Shipping is free too. They don’t want the old ones back. They initially said they felt they were still usable. They are, but they’re a gift for someone else and they look butt ugly. Would you give a damaged book to someone as a gift? No! I wouldn’t either.

I have decided to add Sale Supplies and Shoes envelopes to my cash envelope system. I wear special shoes and they usually cost around $200. I have orthotics that cost around $400. I am going to talk to Hubby about taking the orthotics cost from the Household Health budget. But I will still need to pay for my shoes.

Slightly-early check-in since I’m headed down for a concert tonight and not sure when I’ll be back tomorrow (at least I’ll use up some of those granola bars I bought for my trip)–

Food, $167/$250–More than I planned to spend this week, but picked up some more vegetables (+cream, yogurt, eggs) and vitamins (need to shop around, the brand I like seems to have massively jumped in price) this morning, plus had an unexpected coworker retirement party yesterday evening that ended up being ~$40.

Sports/Health/Hobbies, $0/$100–Nothing this week since concert ticket was a birthday gift, but I’ll end up buying snacks for everyone or something like that

Trip refund/reimbursement, 67%/80%–Main tour reimbursement came in, talking to the second one about if I can apply what I paid or at least some portion of what I paid to a future trip (hopefully I can reschedule for next year)…this one is a little tricky since technically it hasn’t started yet so I can’t say it was cancelled, but at the same time flights still aren’t flying so the argument that they didn’t cancel/are still planning to run the trip is both true and very likely nonsense at the same time. Also re-converting Euros, although I’m guaranteed to lose some there given exchange rates (and that hasn’t gone through so I’m not counting it in the total yet). Still waffling on the camera.

Gifts, $0/no specific budget–Second nephling gets a re-subscription to Highlights and I forgot I’d picked up a kiddie version of Ticket to Ride earlier in the year…that leaves some kind of book for nephling #1 and then I get started on adult gifts.

Not gonna be able to check in til Tuesday. Potty training a toddler this weekend

Weekly check in!

I spent more than I imagined on bed bug recovery items as this does not seem the time to pennywise and pound foolish. That’s the only category I’ve exceeded except for “cash,” made a run to the ATM so a kid could have cash for an outing. But my only goal is total spending - the categories are just to give me an idea.

I am starting to notice that I spend more money than I think on bath salts. That and a bought a bunch of candles when I went to IKEA to get the new bed that doesn’t have bugs I hope.

Chatting with my mom, I told her the whole sob story about having bedbugs and the oven breaking and she Venmo’ed me a couple of grand as a “belated anniversary gift,” which takes the pressure off a little!

Anyway, here’s where I’m at:

| Planned | 10/5 | 10/11 | |

|---|---|---|---|

| Home maintenance and repairs | 2300 | 0 | 0 |

| Household items | 550 | 30.59 | 583.89 |

| Mortgage | 2098.1 | 2098.1 | 2098.1 |

| Groceries | 1600 | 293.92 | 560.75 |

| Restaurants | 250 | 30.59 | 49.67 |

| Baby stuff | 250 | 54.28 | 108.02 |

| Boy stuff | 200 | 27 | 47 |

| Union dues/professional costs | 28 | 0 | 28 |

| Subscriptions | 100 | 3 | 13.78 |

| Misc. bills | 0 | 0 | 0 |

| Utilities | 400 | 0 | 102.76 |

| Health | 200 | 0 | 91.5 |

| Gifts and holiday | 275 | 55 | 161.05 |

| Shopping | 100 | 0 | 0 |

| Cat | 137.33 | 0 | 136.74 |

| Donations | 275.15 | 5.15 | 5.15 |

| Travel | 0 | 0 | 0 |

| Entertainment | 100 | 0 | 37.24 |

| Car payment | 452.05 | 0 | |

| Auto maintenance | 20 | 0 | 3 |

| Taxes and insurance | 165.5 | 165.5 | 165.5 |

| Gas | 30 | 0 | 25.89 |

| Parking, etc. | 0 | 0 | 0 |

| His clothes | 100 | 0 | 0 |

| His misc. spending | 100 | 0 | 10.1 |

| My clothes | 100 | -12.95 | -6.5 |

| My misc. spending | 100 | 0 | 70.37 |

| 9931.13 | 2750.18 | 4292.01 |

Check in 1

Officially I am still at $0/$100 because this week was taken up by a business trip, where my emotional-support-because-I-was-lonely-and-had-to-do-hard-work-things pastries (2) don’t count, nor do the catered desserts (I indulged in about 50% of what was offered, which is better than the 100% I would have enjoyed but far from the 0% my doctor wants to see.) I did go for extra walks to balance out all the sitting in meetings.

The night or two I was home I ate existing treats (did you know that candy from Halloween 2024 that is past its best-before dates is still good? It is. My kids shared with me because they’re going to get a fresh intake of junk in a few weeks.) ![]()

![]() We still have plenty of ice cream in the freezer because it has been summery weather until very recently. I will try to not replace it once it is gone (at least not until it is November and we have defrosted the freezer).

We still have plenty of ice cream in the freezer because it has been summery weather until very recently. I will try to not replace it once it is gone (at least not until it is November and we have defrosted the freezer).

It’s Thanksgiving weekend so there will be desserts at family meals. I expect the remainder of the month will consume the budget I set for October, we’ll see if it was a good goal or not. ![]()

Well, I haven’t yet had the oomph to sit down and reconcile new medical bills with the explanation of benefits statements from the insurer, but I did pay off the credit card that I put the $3,500 emergency room visit for husband’s dog bite early this year on. Paid it with a credit card to get points, paid off before any interest hit.

Actual first check in ![]()

![]()

Gas ![]() $60/200

$60/200

Doing pretty good and going into the week with a full tank! I’ll be driving a lot for work towards the end of the month though.

Grocery ![]() $139/$300

$139/$300

A little over where I’d like to be, but that’s from Korean barbecue last weekend. The rest of the month should be normal shopping.

Eating out ![]() $81/$300

$81/$300

So far I’ve been pretty careful with this! I splurged yesterday on a veggie crepe because I agreed to have lunch with an older friend who is lonely but also can be kind of stressful for me to talk to for a long time. Comfort crepe.

Fun/gifts ![]() $22/$167

$22/$167

I got my dad a fun soap so he’ll have something nice for after his surgery in two weeks. Mailed it to him and also sent a little thing I made to my MIL.

Week 1 Checkin ~~~

This weekend is the first weekly check-in. Nothing has to be perfect! Just check in by posting on this thread and mention where you’re at with your budgetober objectives.

This can be posting how much you’ve spent this week, what problems you ran into with your plan, or asking for help if you need it.

After you post your check-in, myself or another mod will get you a special-edition week 1 budgetober badge. If you still haven’t gotten your badge by Tuesday, please bat signal me (@ anomalily) and I’ll make sure you do!

week 1 check-in!

Total thus far: $183.97

- finished inputting one of three cards into the spending side of the budget. No progress on the investment/income side of the budget

- Little Treats: $12.99 on a six pack of beer

- Groceries: $14.28 - total is at $19.68/$150

Week 1? & 1/2? Check in

Sleep budget: met it 6 of the 7 days this week, so on target

Meals Budget: ate 3+ every day, so on target. A few were in the light side, but the consistency is the goal here. Will work on the content secondarily.

Craft Supply Budget: no spending yet, so on target.