2026 is almost here and we’re continuing the HARD challenge of saving 26% of your income.

We are continuing the 25 in 2025 challenges but have slightly adjusted the goal post for a new year - by 1%!

It’s simple but not easy: save 26% of your income in 2026!

If saving 26% of your income is easy for you (or if your income is over 100K) - please use the alternative 26 in 2026 Challenge: Save $20,260

If saving 26% of your income is easy for you (or if your income is over 100K) - please use the alternative 26 in 2026 Challenge: Save $20,260

Both get the same sticker, but the threads will have people at similar income/challenge levels.*

Basic rules:

- The goal is to save 26% of your pre-tax income in 2024. If you make $40,000 per year, that’s $10,400 or $866 per month.

- DEBT REPAYMENT COUNTS

- You can combine any type of savings: emergency fund, 401K, Super, IRA, ISA, taxable

investments, buffer, house down payment fund, student loan payments - to reach your goal.

- You can choose household or individual salary, whichever you prefer.

What Counts

- Debt repayment counts towards your savings rate!

- Mortgage principal (but not interest or escrow) counts.

- Only savings that occurs between 1/1/2026 and 12/31/2026 count.

- You can use tax refund or any other windfall money towards your savings percentage, but you then must count that windfall towards your overall income.

- You can count your income and savings jointly with a partner or separately - up to you!

- Student loan forgiveness counts (either PSLF or workplace), but only if you also count it in your gross income.

What do you get:

- Support on this thread as you go along - post monthly or quarterly check-ins as appropriate

- A forum badge after you complete your 26% goal for the year

- A sticker mailed to you for free anywhere in the world!

- A shoutout on the livestream for reaching your goal

Here’s all the 26 in 2026 Challenges:

1 Like

I’ve been eyeing this challenge all week, which I think is a sign that I should do it?!

My income varies from year-to-year, but I’m expecting to make at least as much money in 2026 as I did in 2025. Most of my savings is going to be a cash cushion for the weeks of the year where I make low-to-no money. (I’ve been using emergency fund money to get me through these times, but I don’t want to keep eating into that pot of money. It’s for emergencies!!) I also have a small amount of credit card debt that I’ll knock out in January.

4 Likes

Been psyching myself up for this one all year, set my recurring contributions in place get going starting Jan 1 - let’s do it!

(crosses fingers obligatorily)

4 Likes

Mid-month checkin,

My EOM will reflect a previously planned trip to SF, but… I’m feeling good about these numbers thus far, here’s to keeping at it. I did a budget burndown and gutted every non-critical expense to free up overhead for a start-business fund (5k), in addition to hitting my savings % goals. Feels refreshing, and my pocketbook/body health/mental state is currently thanking me for meal prepping at home, a meditative practice I started about a year ago and have now come greatly to enjoy.

4 Likes

First monthly check-in!

January is always a low-paycheck month for me but this year it’s like: ahhh hahahaha why did I think I would be able to pay off my credit card this month???

I made $250 gross this month. Work automatically put $20 in my retirement account, and then

I threw $45 at my credit card balance. That’s 26% of my gross income saved for the month!

5 Likes

January retrospect - I ended up deciding to make two large purchases in addition to my trip to SF. Financial education related so I’m viewing them as “invest in self” type instruments, and it’s nice they’ll be recognized over the next 12 months (see: can plan for them better next year).

In a good spot to build my savings buffer from 2, to 4 months with my paycheck this coming week, in addition to funding YNAB coaching if I am accepted into the program, if not, I’ll pivot that money into building out additional buffer.

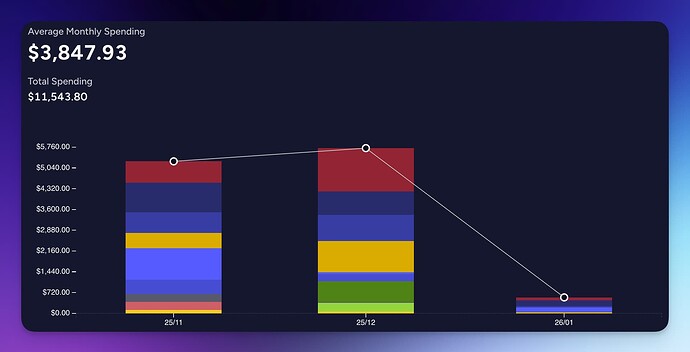

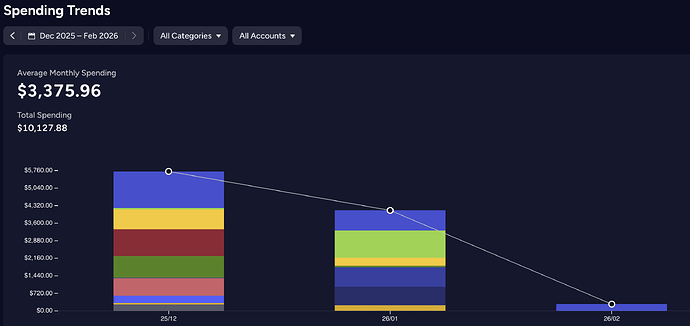

My 3 month moving spending average shrank $1500 overall, so that’s good.

New month, new vigor.

Feb goal: stay on the rails, avoid shiny ideas/objects.

2 Likes

It’s February Check-In Time! 1742.15

Feb. Gross Income: $1,492.15

Feb. Pension Savings: $153.80

Feb. Debt Payments: $260

Monthly % Savings: 28%

YTD % Savings: 27%

2 Likes

![]() If saving 26% of your income is easy for you (or if your income is over 100K) - please use the alternative 26 in 2026 Challenge: Save $20,260

If saving 26% of your income is easy for you (or if your income is over 100K) - please use the alternative 26 in 2026 Challenge: Save $20,260