That’s HUGE. CONGRATULATIONS ![]()

![]()

![]()

![]()

excellent work! the first chunk really is the hardest. you will be amazed to see how it grows over time ![]()

I remember hitting positive net worth and it was incredibly exciting after years of student loan debt keeping me in the red.

10k was pretty sweet, too.

Congratulations! That is a huge and wonderful first step!

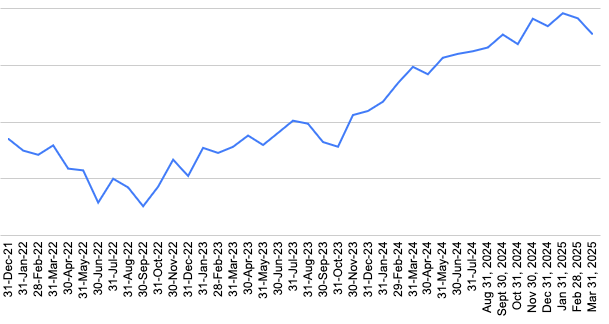

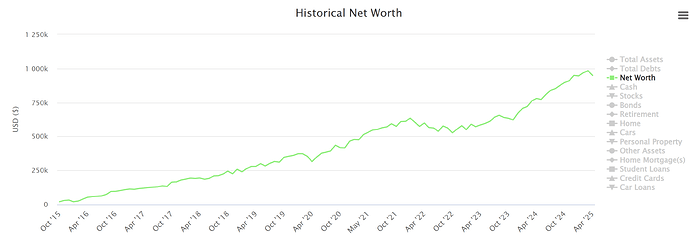

Markets go up, and compensated for the money we took out for living / reno expenses. If we hadn’t taken out the money, we would have crossed that next line, and the graph would have set up yet another line to aim for.

Wooh!

This prompted me to check our graph, and we crossed a line back in November! That was thanks to market increases on our retirement accounts.

My NW went up by $2k even though I spend a huge amount on the renovation. It might have been my most expensive month ever.

I would feel more celebratory if the strong market were because of a benevolent and stable government running our neighbour to the south.

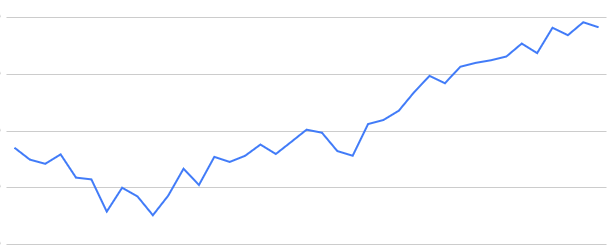

we have two graphs, one that starts when I finalized my decision to quit my ft job, and one that goes back to the start of my tracking in 2008. Since they are looking at different number ranges, the next line is a different number for each of them.

I can’t decide if we’ve hit a new inflection point with the NW which implies a new strategy, or if it is merely recency bias playing with my brain, and we should stay on the path. To Smacky’s point, no actual decisions being made until the house project and our neighbourhood relations are better understood.

Regardless, feelings are fraught on this, as with much else these days.

House rose $80,000 CAD in assessed value. Total Net Worth up $100,000 from this time last year.

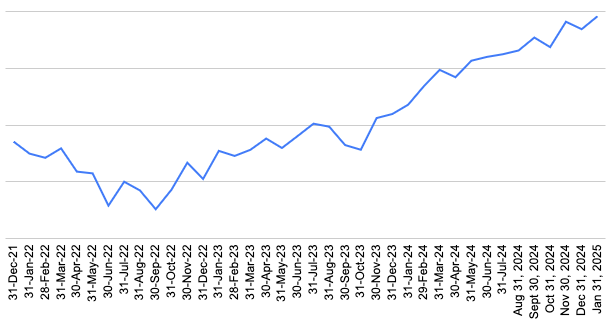

Investments since Dec 31, 2021 (aka fake FIRE)

we are down a bit. the combination of a small rrsp contribution and the shadowy one making a withdrawal. This ignores the mound of cash we’re about to deploy into the home renovation

A reminder that capitalism does not imply democracy

investments since Dec 31, 2021, our baseline for FIRE because everything is artificial

numbers down again this month, and down for year overall. we are back to Sept 2024 numbers for our investments (we have pulled out 2 years of spend in that time to cover living expenses and the upcoming kitchen reno).

capitalism does not care about democracy or human rights, but it does like some degree of predictability

comparing my mood to what I can see from Feb 1 posts is interesting

I spent tens of thousands this month on the renovation and the markets are down. It’s ugly.

it is now May 2024 and going to slide more (because mutual funds take a day to catch up)

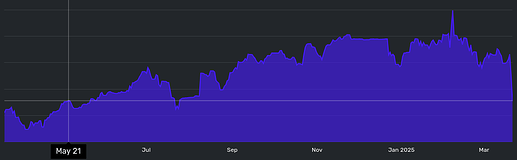

I mean, technically it’s 2025 but VTI is very close to May 2024 levels… ![]()

![]()

That totally went over my head and then I tried to correct you with a joke and now I have egg on my face. Fortunately egg prices have come way down.

it’s a coping technique when markets go down to remember how pleased I was on hitting that number the first time

and in fact May 2024 was an important psychological line

I need to do this rather than being angry about the reason it is currently cratering.

and after yesterday we are back to roughly Feb 2024 (or slightly below Apr 2024), which means that after flirting with going over the next line in Jan, we have dropped below the last line we crossed in the graph

Yep, down we go (end of May for me)…I don’t usually look at investments except once around the end of the month when I drop everything into my spreadsheet, but Simplifi helpfully adds investment pictures when I’m looking at the cc stuff I check weekly:

Okay but that’s just a mean time for a recession, really. We were $17k from crossing the million dollar mark. (I mean, we were there if you count car value, or if we counted house value at current market rate and not how it was assessed at purchase 5 years ago. But still!)

Rude. But also… congrats!