Hahahahha yeah so I am totally not going to save $40,500 for us, unless things change a bunch. I will hopefully meet $20,250.

Yeah I think our deliberate savings is currently net $0.

I haven’t rememberedto update monthly but here is a Q1 update! All these are paycheck savings plus the principal on our mortgage, and it includes my husband’s employer match but not mine because his is a 401(k) and mine is a pension.

Minor variations are just based on fluctuations in our work hours.

January: 1964 (3 paycheck month for me)

February: 1893

March: 1855

Total: 5703

So we are on track so far! I have a decent cash cushion right now so hopefully we won’t need to tap savings for any expenses coming up.

Boring April update! We saved the usual amount of dollars and are now at $7514 for the year, so still on track so far.

I am going to drain our savings to pay for solar panels. I am NOT going to deduct that from the goal to save $20,250. That is the goal in NEW MONEY savings.

Well, I haven’t been posting here. We did the IRAs for 2024 and are doing the HSA maxing. I’m contributing minimally to my Roth 457b ($50 a month) just to say I’m contributing something.

His business has taken off quite a bit, but we have also bought a (used) truck and (new) mini-excavator for the business, so waiting to see how the summer goes. If it goes very well, we may look into a Roth SEP IRA for him rather than upping my contributions - that will take some figuring out, though. We do plan to max out our regular Roth IRAs for 2025 in early 2026, so the question will be if there’s more money we need to invest at that point.

So, numbers.

- 2024 Roth IRA plus ‘you’re old’ catchup for two in Feb. 2025: $7,000 each plus $1,000 catch-up times two = $16,000

- Family HSA max plus $1,000 'you’re old" catchup for 4/10 paychecks for the year (I don’t get paid in June and July): $955 times 4 = $3,820

- Roth 457b at $50 a month times four months = $200

- Pension contributions probably should count but complicated - $425.08 for three months and $411.58 for one month = $1,686.82

- TOTAL TO DATE: $21,706.82

I guess we did it. Feels like cheating since we are front-loaded by my habit of making the prior year IRA contributions when I do the taxes, but especially now with his income irregular, that feels like the best thing to do. I guess it really doesn’t matter since we can take out Roth IRA contributions any time, but my emotions don’t like that.

If we don’t count the pension contribution, which is not optional, we’re not quite there at $20,020 for the year.

TBD if we’ll go for $20,250 per person.

YOU DID A GREAT JOB DON’T UNDERCUT!!!

I will try to make the badge ASAP

Currently at 10,364.30.

Pretty good, considering daycare and lower pay on leave.

Doesn’t matter to me when you make the badge. I know you’re overwhelmed, so do it when you feel like it.

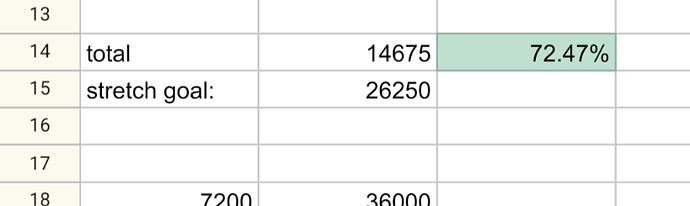

Numbers update above. So challenge completed, but still working on the stretch target. No consideration for package included in this. I also need to stop my RRSP deposits shortly; will do 2 more so I exceed it a little bit which won’t cause a penalty.

Belated update for May: We are at $9313 saved for the year although May was a lower earnings month with just $1799 saved. Our earnings fluctuate a little depending on opportunities for more work hours.

So we are on track (except that I am going to blow a bunch on solar panels but that doesn’t count for this purpose).

I realized that now that I no longer have the ability to fund my HSA, the Boy is supposed to be putting the whole family amount into HIS HSA… but he isn’t, and I can’t do it for him, and he says he is going to do it but just hasn’t gotten around to it.

I have also applied for a FT job which would wildly impact our financial breakdown and who does what if I were to get it (we currently work 50 hours a week between us, and we probably still would or even a bit more, but instead of 20/30 me/him it would be more like 40/10, if his job would let him stay on in a limited role).

mid year update:

I’ve spent some from short term savings, but it’s mostly all still there. and this doesn’t include my mortgage payments.

I hit my $20,250 but I am within striking distance of stretch goal of $25000 -

93.97% of the way there and should hit it next month!

Boring update! June savings were $1861, or $11,174.

I have withdrawn almost as much as that from savings to pay the deposit on the solar panels, but I already said that wasn’t going to count!

Still waiting to hear if I got the new job! They are checking my references but apparently they are checking them THOROUGHLY so they might still be looking at multiple candidates.

Almost halfway to $20250 AUD and just over halfway through the year. TBD if I can catch up or if another minor household disaster occurs ![]()

Chugging along with $13052 saved YTD. That’s still not counting what I took out for the solar panels!

HELL YEAH

WOOOH! that’s awesome!

It’s starting to look like probably not, but with him working a lot less taking me to hospitals and the like. But he’s doing well, plenty of business available. He’s talking about hiring someone extremely part time to help him out.

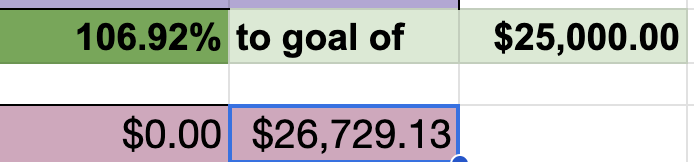

Currently at $19,022.60.

We’re on track to max our 401ks but also have been using cash from savings to cover daycare expenses so that we can continue plonking money into the 401ks. It’s the right balance for right now, especially because we should max out in like October and then we’ll have a big old influx of cash into the savings again.

Next year we need to spread the savings out a bit more and not weight it quiiiite so heavily towards the beginning of the year. I really did not need to be so aggro.